Introduction

Whether you’re a seasoned developer or a first-time real-estate business owner, the idea of “cost records” and “cost annexure” might sound like dry compliance work. But—and this is the important bit—getting them right can sharpen your decision-making, lock in better margins and keep you on the right side of regulators.

In this blog we’ll walk through how to create cost records and cost annexures in the real-estate / construction world in India. We’ll unpack what needs to go in, how to structure the tables, reference the relevant Cost Accounting Standards (CAS) and government norms, illustrate with examples and make it approachable for lay-persons, professionals and business people alike.

Let’s bring some energy to this—because cost control in real estate is exciting (yes, really) when you see how it transforms your bottom-line.

Why Cost Records & Cost Annexure Matter in Real Estate

1. Compliance & risk mitigation

Under The Companies (Cost Records and Audit) Rules, 2014 read with Companies Act, 2013, companies in certain segments (including construction / real-estate development) must maintain cost accounting records and in some cases have a cost audit.

If you skip this, you may face show-cause notices, penalties or qualification of your audit report.

2. Better decision making

When you capture cost data project-wise, you know what drives costs, where you’re bleeding money, whether you should tweak design/contractors or re-negotiate vendors. The guidance note for construction & real estate emphasises cost object definition, overhead apportionment, etc.

3. Transparency and stakeholder confidence

Investors, lenders and stakeholders like to see structured cost data. A well-prepared cost annexure shows you’re disciplined, which builds trust.

Key Regulatory & Standards References

- The Companies (Cost Records and Audit) Rules, 2014.

- Guidance Note on maintenance of cost accounting records for construction / real estate & property-development industry by the Institute of Cost Accountants of India (ICMAI) / CARR. icmai.in

- CAS (Cost Accounting Standards) issued by the Cost Accounting Standards Board of ICMAI. For example, CAS-1 (Classification of Cost), CAS-3 (Overheads) are relevant.

- Applicability thresholds: When maintenance of cost records is required (turnover of ₹35 crore or more) and when cost audit is triggered (₹100 crore or more) for construction/real estate.

Step-by-Step: Creating Cost Records for a Real Estate Project

Step 1: Define your cost object(s)

In real estate/development, a “cost object” could be:

- A specific project (e.g., “Golden Heights Township Phase I”)

- A sub-project or building block (e.g., “Tower A, Wing 3”)

- A service component (e.g., “land-purchase + development”, “township infra”)

The guidance note says you must define cost objects clearly — each site or sub-project should have a unique identifier.

Step 2: Decide your cost classification & cost centres

You’ll need to capture costs under broad heads and cost-centres. Typical cost centres in real estate might include:

| Cost Centre | Description |

|---|---|

| Land Acquisition | Purchase price, registration, stamp duty |

| Construction (Direct) | Materials, labour, subcontractors directly on site |

| Construction (Indirect) | Site supervision, security, utilities, off-site |

| Infrastructure & Services | Roads, drainage, landscaping, electrification |

| Marketing & Sales | Advertising, sales office, brokering commissions |

| Admin / Head Office | HQ salaries, travel, depreciation of office assets |

CAS-1 & the Rules ask you to ensure that allocation of costs (direct & indirect) is fair, consistent and disclosed.

Step 3: Capture materials, labour, subcontract costs, overheads

Your cost records must show the quantity and value of each input (where applicable) and allocate appropriately. For example:

- Materials: cement, steel, bricks — quantity + cost

- Labour: direct site labour, contractual supervisors

- Utilities: power, water consumed on site

- Overheads: admin, head-office support, shared services

From the rules: e.g., “the records shall indicate the quantity and cost of each major utility …”

Step 4: Apportion / allocate overheads

Overheads that serve multiple projects or cost-centres must be allocated on an equitable and reasonable basis. Examples: head-office support, finance & accounts, IT. The guidance note emphasises this.

Step 5: Prepare project cost statement (periodic)

You should prepare cost statements (quarterly, yearly) that show something like:

- Actual vs Budget

- Cost of project to date

- Cost per unit (e.g., per sq ft)

- Margin / expected profit

These statements form a part of cost records and are required under the Rules.

Step 6: Create the Cost Annexure (to Cost Audit Report)

If your company requires a cost audit, you’ll attach an annexure to the cost audit report (Form CRA-3/CRA-4) which includes detailed schedules, cost accounting policies, product/service details etc.

The annexure typically includes:

- General information (company name, year, cost auditor)

- Cost accounting policy adopted (identification of cost objects, overhead apportionment, inventory valuation etc)

- Product/service details: unit of measure, revenue, etc.

- Quantitative statements and cost schedules per cost object

Example: Cost Record Table for a Residential Tower Project

Let’s assume you are developing “Sunrise Glen – Tower B (100 units)”. Here is a simplified table for cost-tracking (for FY 2024-25).

| Cost Centre | Budget (₹ lakhs) | Actual (₹ lakhs) | Variance (₹ lakhs) | Notes |

|---|---|---|---|---|

| Land Acquisition | 800 | 820 | +20 | Extra legal cost |

| Direct Construction | 1200 | 1150 | –50 | Cost efficient labour deal |

| Indirect Construction | 150 | 170 | +20 | Higher utilities cost |

| Infrastructure & Services | 120 | 110 | –10 | Landscaping deferred |

| Marketing & Sales | 80 | 75 | –5 | Early bookings reduced cost |

| Admin / Head Office | 40 | 45 | +5 | IT upgrade happened |

| Total | 2390 | 2370 | –20 | Project currently under budget |

From here, you might compute cost per sq ft (if typical unit size is 1,200 sq ft × 100 units = 1,20,000 sq ft) → ₹ 19.75 lakhs per unit (₹ 2370 lakhs /100 units). This helps pricing, margin analysis etc.

Example: Snippet of Cost Annexure – Policy & Cost Object Section

Cost Accounting Policy

The company adopts “project-wise” cost accumulation. Each tower is treated as a cost object. Overheads of head office are apportioned to each cost object based on floor-area of the tower. Inventory (material on site) is valued at weighted average cost. Abnormal costs (e.g., penalty for delay) are shown separately and not absorbed into the regular cost pool.Product/Service Details

Cost object UOM Covered under cost audit (Yes/No) Net Operational Revenue Current Year (₹) Previous Year (₹) Sunrise Glen-Tower B Unit Yes 600 lakhs 0 lakhs

This kind of table is part of the Annexure in Form CRA-3/CRA-4.

Common Pitfalls & Tips – Avoid These Mistakes!

- Not defining cost objects clearly: If you mix multiple towers/projects in one cost pool, you lose granularity.

- Poor allocation of overheads: Head-office costs or shared services not apportioned appropriately will distort your cost per unit. The rules require a “reasonable and equitable basis”.

- Ignoring time-lag costs / finance costs: Real-estate projects span long time periods; financing costs, delay penalties, idle time must be captured. The guidance note emphasises that cost objects may span >12 months.

- Incorrect applicability assumptions: Just because you’re in real estate doesn’t automatically trigger cost audit; you must check turnover thresholds and other criteria.

- Late preparation / approval of annexure: The annexure must be approved by Board and sent together with the cost audit report.

Tip: Make monthly or quarterly cost-reports even if audit is yearly. It gives management realtime insight and helps avoid end-year scramble.

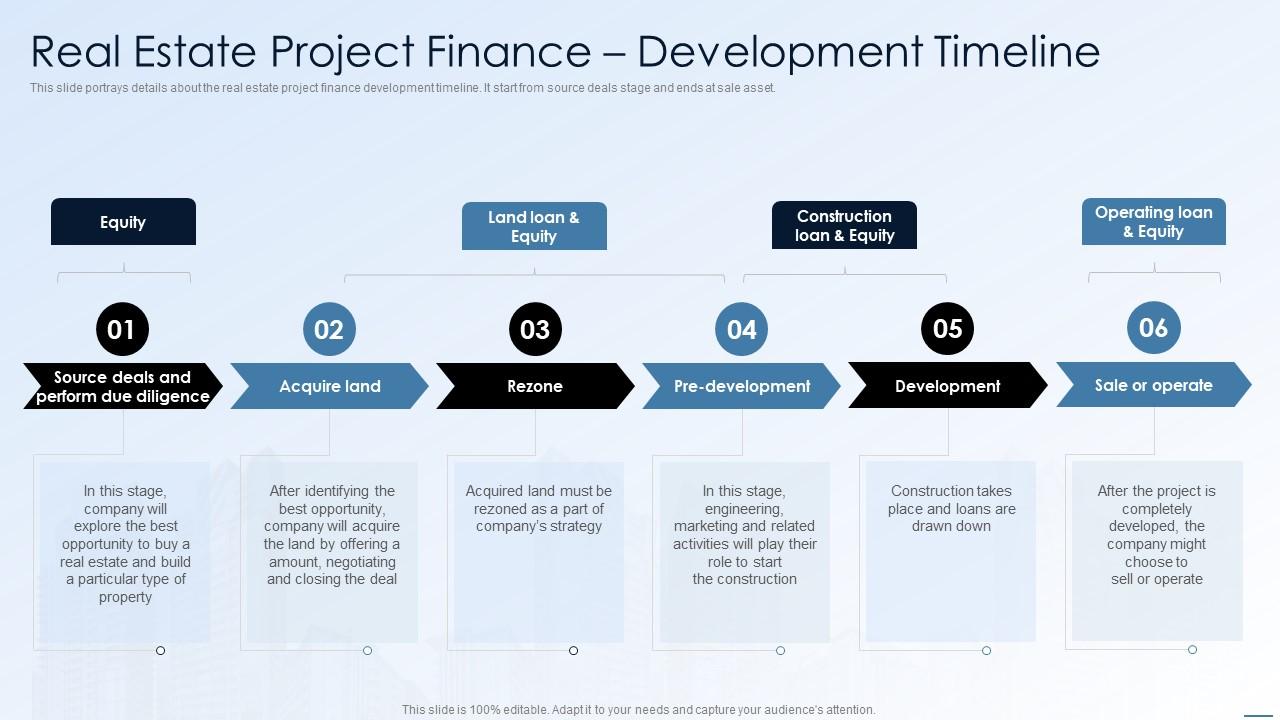

Graphical View – For Better Understanding

Real-World Mini Case Study

Let’s say ABC Developers Pvt Ltd is developing a “Lakeside Residences” township. Turnover in preceding year was ₹120 crores, so cost audit under the Rules is applicable. (Construction/real-estate with >₹100 crore turnover).

They defined three towers as cost objects: Tower X, Tower Y, Tower Z. They captured:

- Land cost per tower (allocated by area)

- Direct construction by contractor invoices per building

- Site overheads by site time logs

- Head-office overheads (finance, HR) apportioned by floor-area

At year‐end they produced the Annexure, including: cost accounting policy, cost object list, per tower cost tables, cost per sq ft, variance analysis vs budget. They passed this to the cost auditor, got the cost audit report (Form CRA-3) and filed CRA-4 with Ministry of Corporate Affairs.

Because of this process:

- They found Tower Y was 12% over budget due to high utilities & delay penalties → corrective action early in next phase.

- They could present cost / unit and margin to their bank for project funding with confidence.

- They avoided possible regulatory headache since records were in place.

Summary & Final Checklist

In short:

To create cost records and cost annexure in the real-estate industry:

- Define cost objects (projects, towers)

- Identify cost centres (land, direct construction, infra, marketing, overheads)

- Capture inputs – quantity + value – materials, labour, utilities

- Allocate and apportion overheads appropriately

- Prepare periodic cost statements (monthly/quarterly/year)

- If audit applicable: compile annexure with cost accounting policy, object details, cost-schedules, and integrate it into CRA-3/CRA-4 report

- Ensure compliance with CAS, CARR rules, and get Board approval for annexures

Final Checklist for your business:

| Item | Completed? |

|---|---|

| Threshold check (is records/audit applicable?) | [ ] |

| Cost object list documented | [ ] |

| Cost centres defined | [ ] |

| Monthly/Quarterly cost tracking in place | [ ] |

| Overhead allocation method documented | [ ] |

| Cost accounting policy drafted | [ ] |

| Cost annexure template ready | [ ] |

| Board approval process for annexure defined | [ ] |

I hope this gives you a powerful, practical, and engaging guide to doing cost records and cost annexures in real-estate. If you like, I can draft a template annexure (Excel or Word) specifically for a real-estate project & adapt it to your business. Would you like me to do that?